- Prevenar maintains lead in pneumococcal vaccine mkt

- by Hwang, Byung-woo | translator Kang, Shin-Kook | Aug 12, 2024 05:54am

The Q2 share report, which is the first report issued after Vaxneuvance’s introduction in April, showed that while Pfizer's Prevenar 13 sales remained strong, Vaxneuvance gained a larger share of the non-reimbursed adult pneumococcal vaccine market.

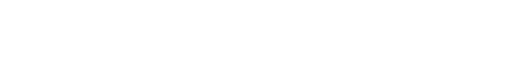

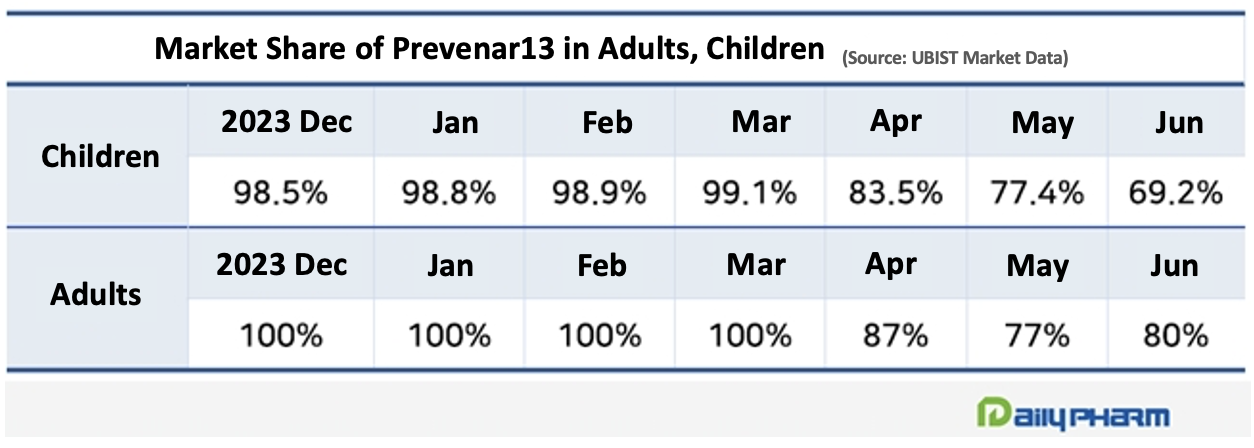

Prevenar 13 was the dominant pneumococcal vaccine in Korea’s market prior to the introduction of Vaxneuvance. It generated KRW 45.8 billion in sales last year (IQVIA data), and the drug occupied 98.9% in March 98.9% among children and 100% among adults (UBIST data).

However, since the launch of Vaxneuvance in April, the market’s focus of interest has been on how the emergence of the Prevenar 13’s competitor. The first report card issued in Q2 can be summarized as Prevenar 13’s solid defense despite the strong advance made by Vaxneuvance.

According to UBSIT, Prevenar 13 led the pneumococcal vaccine market in June last year, occupying 69.2% of the pediatric pneumococcal vaccine market. The company's market share declined from 99.1% in March to 83.5% in April and then to 77.4% in May, but is still holding the majority of the market.

The gap widens when considering the adult pneumococcal vaccine market. After reaching an 87% share in April, Prevenar 13’s share had dropped to 77% in May, but rebounded to 80% in June, showing even greater market dominance than in the pediatric pneumococcal vaccine market.

The industry has linked this to Vaxneuvance’s rapid registration into the National Immunization Program (NIP). Vaxneuvance entered the pediatric NIP within a month of its approval late last year and was covered through the NIP upon its launch.

As a result, MSD focused on the pediatric market launch, using up most of its initial supply for NIP.

The company's strategy was to aggressively target the NIP market, where it can expect stable sales. At a media seminar held on August 6, MSD said that it has been gaining a double-digit share every month.

While the pediatric NIP market is likely to remain competitive, the adult market, where Prevenar 13 has an 80% share, is likely to be a concern for MSD.

Contrary to how the NIP market is less commercially driven, the off-patent market is more likely to reflect the company’s marketing capabilities.

MSD is emphasizing that Vaxneuvance has 2 more - 22F and 33F - unique serotypes compared with Prevenar 13 and with confirmed good immunogenicity. The Korean Society of Infectious Diseases recently recommended Vaxneuvance as a priority in the revised 2024 Adult Vaccination Guidelines.

However, how the doctors will regard the difference of adding the 2 serotypes - 22F and 33F - in practice will be key, as the 10A serotype is found more in children and 3 and 19A serotypes in adults in Korea, and 19A and 19F serotypes are the most frequent serotypes among serotypes preventable through children’s vaccines.

The next variable in the competition between the 2 vaccines will be Pfizer's follow-on vaccine, Prevenar 20. Industry insiders expect Prevenar 20 may be approved later this year and launched at the end of the year at the earliest.

Although the new vaccine will not be able to influence the NIP market or guidelines in the short term, from the perspective of Vaxneuvance, the emergence of Pfizer's follow-up vaccine less than a year after its market launch can rise as a concern when expanding its share.

Regarding this, a Pfizer representative said, "It is difficult to predict the timing of Prevenar 20’s approval, but we are working to launch the vaccine as soon as possible."

-

- 0

댓글 운영방식은

댓글은 실명게재와 익명게재 방식이 있으며, 실명은 이름과 아이디가 노출됩니다. 익명은 필명으로 등록 가능하며, 대댓글은 익명으로 등록 가능합니다.

댓글 노출방식은

댓글 명예자문위원(팜-코니언-필기모양 아이콘)으로 위촉된 데일리팜 회원의 댓글은 ‘게시판형 보기’와 ’펼쳐보기형’ 리스트에서 항상 최상단에 노출됩니다. 새로운 댓글을 올리는 일반회원은 ‘게시판형’과 ‘펼쳐보기형’ 모두 팜코니언 회원이 쓴 댓글의 하단에 실시간 노출됩니다.

댓글의 삭제 기준은

다음의 경우 사전 통보없이 삭제하고 아이디 이용정지 또는 영구 가입제한이 될 수도 있습니다.

-

저작권·인격권 등 타인의 권리를 침해하는 경우

상용 프로그램의 등록과 게재, 배포를 안내하는 게시물

타인 또는 제3자의 저작권 및 기타 권리를 침해한 내용을 담은 게시물

-

근거 없는 비방·명예를 훼손하는 게시물

특정 이용자 및 개인에 대한 인신 공격적인 내용의 글 및 직접적인 욕설이 사용된 경우

특정 지역 및 종교간의 감정대립을 조장하는 내용

사실 확인이 안된 소문을 유포 시키는 경우

욕설과 비어, 속어를 담은 내용

정당법 및 공직선거법, 관계 법령에 저촉되는 경우(선관위 요청 시 즉시 삭제)

특정 지역이나 단체를 비하하는 경우

특정인의 명예를 훼손하여 해당인이 삭제를 요청하는 경우

특정인의 개인정보(주민등록번호, 전화, 상세주소 등)를 무단으로 게시하는 경우

타인의 ID 혹은 닉네임을 도용하는 경우

-

게시판 특성상 제한되는 내용

서비스 주제와 맞지 않는 내용의 글을 게재한 경우

동일 내용의 연속 게재 및 여러 기사에 중복 게재한 경우

부분적으로 변경하여 반복 게재하는 경우도 포함

제목과 관련 없는 내용의 게시물, 제목과 본문이 무관한 경우

돈벌기 및 직·간접 상업적 목적의 내용이 포함된 게시물

게시물 읽기 유도 등을 위해 내용과 무관한 제목을 사용한 경우

-

수사기관 등의 공식적인 요청이 있는 경우

-

기타사항

각 서비스의 필요성에 따라 미리 공지한 경우

기타 법률에 저촉되는 정보 게재를 목적으로 할 경우

기타 원만한 운영을 위해 운영자가 필요하다고 판단되는 내용

-

사실 관계 확인 후 삭제

저작권자로부터 허락받지 않은 내용을 무단 게재, 복제, 배포하는 경우

타인의 초상권을 침해하거나 개인정보를 유출하는 경우

당사에 제공한 이용자의 정보가 허위인 경우 (타인의 ID, 비밀번호 도용 등)

※이상의 내용중 일부 사항에 적용될 경우 이용약관 및 관련 법률에 의해 제재를 받으실 수도 있으며, 민·형사상 처벌을 받을 수도 있습니다.

※위에 명시되지 않은 내용이더라도 불법적인 내용으로 판단되거나 데일리팜 서비스에 바람직하지 않다고 판단되는 경우는 선 조치 이후 본 관리 기준을 수정 공시하겠습니다.

※기타 문의 사항은 데일리팜 운영자에게 연락주십시오. 메일 주소는 dailypharm@dailypharm.com입니다.

- [Op-Ed] Patients, no time left for 'new drug comb therapies'

- Special Contribution | Eo, Yun-Ho